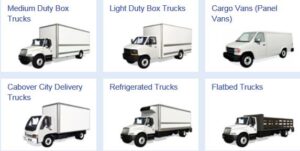

Straight truck or box truck refers to small to middle weight truck usually under 66,000 GVW and usually under 26 feet in length.

Submit below for a quote and feel the difference dealing with brokers that know how to issue and service your account.

Get a straight truck or box truck insurance quote started right now and get expert help making sure you have what you need for your jobs, especially for meeting Amazon insurance requirements (833) 516-9321.

Find the best box truck insurance in the USA . We appreciate each and every customer! Let us help you today.

Straight Truck Insurance & Box Truck Insurance quotes for small risks to large national fleets are always available from our brokerage department by using our easy contact form.

We are a multi-state agency specializing in transportation insurance, including Tractor Trailers, Straight Trucks, Box Trucks, Public Livery, Courier fleet packages and almost all contractor vehicle types.

Everyday day customers ask us “how much does it cost to insure a box truck?” Well, that answer is not as easy as it seems because each company is unique and has different drivers with varying experience. We do our very best to put together the best box truck insurance policy at the cheapest price from the best straight truck insurance companies, including fleets.

Our Commercial Auto Insurance Most Requested

Straight or Box Truck Insurance

Commercial Contractor Vehicle Insurance

Personal Auto Insurance with business use

Local, intermediate and long distance Trucking Insurance owner operator to fleet size

Amazon Hauler Insurance

5 – 40 truck fleet Insurance

Bread Truck Insurance

Other Business Insurance Available

Business Owners Property Insurance

Business Owners Casualty Insurance

General Liability Insurance

Professional Liability Insurance

Workers’ Compensation Insurance

Contractors Insurance (CGL) Paper GC’s

Inland Marine Insurance

Compare the best Straight and box truck fleet insurance. Insure fleets of all different shapes and sizes with commercial box truck auto insurance and general liability.

Straight truck insurance is a necessary expense for any business that owns and operates straight trucks. While it can be costly, there are ways to save money on your straight truck insurance coverage. This guide will provide you with the best tips and hacks to help you get the most out of your straight truck insurance coverage and save money in the process. Whether you own a large or small company, our straight truck owner operators or fleet insurance agents can help you find the most discounts available.

What is Straight Truck Insurance?

Straight truck insurance is a type of commercial vehicle insurance that provides coverage for straight trucks owned and operated by businesses. It covers a variety of risks associated with operating a straight truck, including liability for bodily injury and property damage caused by an accident, as well as collision and comprehensive coverage for physical damage to the vehicle itself. In addition, it also provides protection against theft, fire, vandalism, and other risks.

Why Do You Need Straight Truck Insurance?

Straight truck insurance is required by law in most states in order to legally operate a straight truck. Without it, you could be subject to fines or even criminal charges if you are involved in an accident without adequate coverage. In addition, it provides financial protection in case of an accident or other incident involving your straight truck. Without it, you could be liable for any damages or injuries caused by your vehicle.

Tips & Hacks to Save Money on Your Straight Truck Insurance Coverage

1. Shop Around: The first step in saving money on your straight truck insurance coverage is to shop around for the best rates. Different insurers may offer different rates and discounts, so it’s important to compare quotes from several companies before making a decision. This will help ensure that you get the best deal possible on your coverage.

2. Bundle Policies: Bundling multiple policies with one insurer can often result in significant savings on your overall premium costs. For example, if you have multiple vehicles that need to be insured, consider bundling them all together with one insurer rather than purchasing separate policies for each vehicle. This could result in substantial savings on your overall premium costs.

3. Increase Your Deductible: Increasing your deductible is another way to save money on your straight truck insurance coverage. By increasing your deductible, you agree to pay more out-of-pocket expenses before the insurer pays out any claims made against your policy. This can result in significant savings on your overall premium costs since the insurer will not have to pay out as much if there is an accident or other incident involving your vehicle.

4. Take Advantage of Discounts: Many insurers offer discounts for certain types of drivers or vehicles, such as those with good driving records or those who have taken driver safety courses. Be sure to ask about any available discounts when shopping around for straight truck insurance coverage so that you can take advantage of them and save money on your premiums.

5. Consider Higher Liability Limits: Increasing the amount of liability coverage on your policy can also help lower your premiums since higher limits mean more protection for you in case of an accident or other incident involving your vehicle. However, it’s important to make sure that the increased limits are appropriate for the type of vehicle being insured since some insurers may require higher limits for certain types of vehicles due to their higher risk profiles.

6. Review Your Policy Annually: Finally, it’s important to review your policy annually to make sure that it still meets your needs and that you are taking advantage of any available discounts or changes in rates from year-to-year due to changes in laws or regulations governing commercial vehicle insurance policies. This will help ensure that you are getting the most out of your policy while still staying within budget when it comes time to renew each year.

Straight truck insurance is an essential expense for any business that owns and operates these vehicles but there are ways to save money on this type of coverage if you know what steps to take and where to look for discounts and savings opportunities. By following these tips and hacks outlined above, you should be able to get the most out of your straight truck insurance coverage while still staying within budget when it comes time to renew each year

Items to be aware of.

Drivers List

All carriers must provide a list of currently employed drivers. This list is used to assess applicability of various regulations, and should include: each driver’s first and last name, date of birth, date of hire, license number, and license State.

Driver’s License

All commercial motor vehicle (CMV) drivers must be appropriately licensed to drive the specific type of vehicles they operate. Appropriate licenses are either an Operator’s License issued by one State or jurisdiction, a Commercial Driver’s License (CDL) (with proper endorsements as necessary). In order to obtain any of these licenses, drivers must have passed a knowledge and skills test for the appropriate type of vehicle.

An Operator’s License is required for drivers of CMVs that

Have a gross vehicle weight rating (GVWR) or gross combination weight rating (GCWR) of 10,000 – 26,000 lbs. (including towing vehicle)

Transport 8 – 15 passengers (including the driver) for compensation (for-hire)

A CDL is required for drivers of CMVs that:

Have a GVWR or GCWR of 26,001 lbs. or more (including towed trailers/vehicles)

Transport 16 or more passengers (including the driver) either for compensation (for-hire) or not for compensation (private)

Drug and Alcohol Program

Motor carriers whose drivers are required to have CDLs must have a drug and alcohol testing program.

Motor carriers operating vehicles requiring a CDL must test drivers and other safety-sensitive employees for illegal substances and alcohol levels at various points of employment:

Before they are hired (pre-employment screening)

After an accident

When there is reasonable suspicion

At return to duty after a controlled substances or alcohol violation

Through a random testing process if the carrier has two or more drivers

If the carrier has two or more drivers, a random testing process must be used.

Exceptions

Motor carriers that do not operate vehicles requiring a CDL.

Motor carriers subject to the Federal Transit Administration’s (FTA) alcohol and controlled substance testing program

Employers and drivers that include: active duty military personnel; members of the reserves; members of the national guard on active duty (including personnel on full-time national guard duty, part-time national guard training, and national guard military technicians), and active duty U.S. Coast Guard personnel

Farm vehicle drivers when the vehicle is: Controlled and operated by a farmer as a private motor carrier of property

Being used to transport agricultural products or farm machinery and/or supplies to or from a farm.

Not being used in the operation of a for-hire carrier.

Not carrying placardable HM.

Being used within 150 air miles of the farm.

Firefighters or other persons who operate commercial motor vehicles that are necessary for the preservation of life or property or the execution of emergency governmental functions, are equipped with audible and visual signals, and are not subject to normal traffic regulations’

Learn more at https://ai.fmcsa.dot.gov/NewEntrant/MC/Overview.aspx

Our mission is to be a commercial insurance agency that customers can trust. We are interested in developing long term relationships with our customers and giving them the information they need to make an informed educated decision about their Straight/Box truck insurance and other related business insurance needs if needed.

Straight Truck Insurance Brokers has revolutionized the process of obtaining COI’s with their super quick professional delivery of Certificates of Insurance (COI’s). Their proprietary technology makes the process incredibly easy and fast, allowing customers to quickly and easily obtain the documents they need to secure their loads. The company also offers a number of additional services, such as providing advice and assistance, discounts and free resources to help customers make informed decisions about their insurance coverage. All in all, Straight Truck Insurance Brokers are the go-to choice for individuals and fleets of trucks that are looking to quickly and easily secure their loads.

Our most popular straight truck insurance states are below – find the best box truck insurance in Alabama, Arkansas, Florida, Georgia, Iowa, Indiana, Kansas, Missouri, Mississippi, Nebraska, New Jersey, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee and Virginia. We appreciate each and every customer! Let us help you today (833) 516-9321.

Potential Commercial Auto Carriers

*Varies by state*