Georgia Straight and Box Truck Insurance Experts

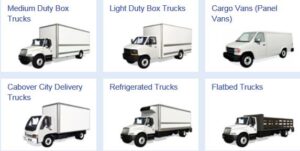

We offer some of the best Georgia Straight Truck Insurance coverage possible in GA for your small medium and heavy size trucks. Georgia Straight Truck Insurance covers hundreds of business types including fleets. Call for quotes and help (833) 516-9321.

Get a Georgia straight truck insurance quote started right now and get expert help making sure you have what you need for your jobs.

Straight Truck Insurance quotes for one truck to fleets are currently available from our GA brokerage department by using our easy contact form.

If you are ready to supply the information call now or use quick quote form below or visit our complete insurance quote request form.

We are a multi-state commercial insurance agency specializing in transportation insurance, including Tractor Trailers, Straight Trucks, Box Trucks, cutaways and almost all contractor vehicle types.

Straight truck insurance requirements in Georgia are necessary to ensure truckers are properly protected while operating their straight trucks. Georgia is one of the most heavily regulated states when it comes to trucking, and this means that meeting the required insurance standards is essential for truckers operating in the state.

Straight truck insurance brokers are an invaluable resource for GA truckers looking to save money on their insurance and stay in compliance with state and federal regulations. These brokers can help truckers understand the various insurance requirements, and then provide them with the best coverage for their needs at the lowest possible cost.

In this article, we’ll be taking a comprehensive look at Georgia’s straight truck insurance requirements, and how straight truck insurance brokers can help truckers in the state save money and stay in compliance.

Georgia Straight Truck Insurance Requirements

Georgia has some of the most stringent straight truck insurance requirements in the country. All straight trucks operating in the state must carry at least the minimum required liability coverage, as well as additional optional coverages.

Minimum Liability Coverage

Every straight truck operating in Georgia must carry at least the minimum liability coverage required by the state. The minimum liability coverage for straight trucks in Georgia is a combined single limit of $300,000. This means that the total amount of coverage for bodily injury and property damage is capped at $300,000.

This minimum coverage amount is designed to protect both the trucker and other drivers in the event of an accident. It is important to note that this amount is not sufficient to cover the cost of repairs and medical bills in the event of an accident, so it is recommended that truckers carry higher liability limits if possible.

Optional Coverages

In addition to the minimum liability coverage, truckers in Georgia are also required to carry certain optional coverages. These include:

• Uninsured/Underinsured Motorist Coverage: This coverage provides protection in the event that the other driver in an accident does not have enough insurance to cover the full cost of damages. It is important to note that this coverage is not required in Georgia, but it is highly recommended.

• Comprehensive Coverage: This coverage provides protection against damage to the truck due to non-collision related events, such as fire, theft, vandalism, and more.

• Collision Coverage: This coverage provides protection in the event of an accident, regardless of who is at fault. It is important to note that collision coverage is not required in Georgia, but it is highly recommended.

• Cargo Insurance: This coverage provides protection for any cargo that is being transported in the truck. It is important to note that cargo insurance is not required in Georgia, but it is highly recommended.

• Non-Trucking Liability Coverage: This coverage provides protection for truckers in the event that they are involved in an accident while not in the course of their trucking duties. It is important to note that non-trucking liability coverage is not required in Georgia, but it is highly recommended.

How Straight Truck Insurance Brokers Help GA Truckers Save Money

Straight truck insurance brokers are an invaluable resource for GA truckers looking to save money on their insurance and stay in compliance with state and federal regulations. These brokers can help truckers understand the various insurance requirements, and then provide them with the best coverage for their needs at the lowest possible cost.

One of the biggest advantages of working with a straight truck insurance broker is that they have access to a wide range of insurance providers. This means that they can compare the different insurance plans and find the one that offers the best coverage for the lowest price.

In addition, straight truck insurance brokers are experienced in the trucking industry and can help truckers understand the various insurance requirements and regulations. This can be invaluable for truckers who are unfamiliar with the laws and regulations, as it can save them from making costly mistakes.

Finally, straight truck insurance brokers can provide valuable advice and guidance for truckers. This can help truckers make more informed decisions about their insurance, and ensure that they are properly protected while operating their straight trucks.

Straight truck insurance requirements in Georgia are necessary to ensure truckers are properly protected while operating their straight trucks. Georgia is one of the most heavily regulated states when it comes to trucking, and this means that meeting the required insurance standards is essential for truckers operating in the state.

Straight truck insurance brokers are an invaluable resource for GA truckers looking to save money on their insurance and stay in compliance with state and federal regulations. These brokers can help truckers understand the various insurance requirements, and then provide them with the best coverage for their needs at the lowest possible cost.

If you’re a trucker in Georgia looking for the best coverage at the lowest cost, then working with a straight truck insurance broker is the best way to ensure you’re properly protected and in compliance with the law.

GA Commercial Auto Insurance Most Requested

GA Straight or Box Truck Insurance

GA Commercial Contractor Vehicle Insurance

GA Local, intermediate and long distance Trucking Insurance

Dump Truck Insurance

Tow Truck Insurance

Georgia Business Owners Property Insurance

Business Owners Casualty Insurance

General Liability Insurance

Professional Liability Insurance

Workers’ Compensation Insurance

Business Interruption Insurance

Contractors Insurance (CGL) Paper GC’s

Inland Marine Insurance

COVERAGES*

In most states like Georgia, liability coverage is mandatory by state and or federal guidelines. All other coverage’s are optional. If your car is leased or financed, you may be required to buy certain coverage limits. Talk through your insurance needs with your independent agent or broker to be certain you have the coverage’s you need.

› Collision

Collision coverage pays for damages if your vehicle overturns or if it collides with another vehicle or object.

Collision coverage is subject to a deductible amount that you choose. The most frequently selected deductible amount is $500. Select a deductible amount that you are comfortable with – if there is a Collision claim on your policy, this will be the amount you’ll generally be required to pay.

› Comprehensive

Comprehensive coverage pays for damage caused by an event other than a car collision, such as fire, theft, vandalism, hail or flood. Comprehensive also covers damage from hitting an animal and covers the cost of a rental if your car is stolen. Comprehensive coverage is also subject to a deductible amount – usually the same amount you choose for Collision coverage.

› Liability

Bodily Injury and Property Damage (BI/PD) liability covers your legal liability, up to the limits you select, for damages caused in a covered vehicle accident. If we cover an accident for which you’re sued, we pay for a lawyer to defend you.

You choose your liability limits as either Split Limits or a Combined Single Limit (CSL). Split Limits divide Bodily Injury liability limits per person and per accident. (For example, $100,000/$300,000 means that we will pay for up to $100,000 for Bodily Injury liability per person in a covered crash and up to $300,000 per crash.) For Property Damage, we pay up to the limit you select per accident. CSL combines your liability coverage into one total limit per accident ($300,000).

› Personal Injury Protection

Personal Injury Protection (PIP) is available in certain states and is commonly referred to as “no-fault insurance.” PIP covers your medical bills and often lost wages. PIP usually also covers the cost of personal services you must pay someone else to do for you as a result of a car accident.

› Medical Payments

Medical Payments coverage applies no matter who is at fault and covers the cost of reasonable and necessary medical care provided to you as a result of a car accident.

› Uninsured/Underinsured Motorist

Uninsured/Underinsured Motorist coverage pays for damages that you are legally entitled to recover for your bodily injury. In general, this coverage provides what you would have received from the other person’s insurance company if that person had insurance. This coverage may also protect you if the person who caused the damage does not have enough insurance.

› Rental Reimbursement

If you buy Rental Reimbursement coverage, we will reimburse you for rental car charges incurred while your vehicle is being repaired after a covered accident. You can only buy Rental Reimbursement coverage if you buy Collision and Comprehensive.

› Roadside Assistance

Roadside Assistance covers labor costs incurred at the place where your vehicle becomes disabled as a result of a mechanical/electrical breakdown, dead battery, flat tire, and/or lock-out. We will also help if you run out of gas or other fluid or become stuck in snow or mud within 100 feet of a road or highway. If necessary, Roadside Assistance will cover towing to the nearest qualified repair facility.

We write GA Straight and Box truck insurance and commercial auto insurance coverage in the following counties in Georgia.

If you have questions and need answers about your commercial vehicles we recommend that you visit the state of Georgia DDS.

Below are the major cities in Georgia where we have helped companies with their insurance.

1. Atlanta

2. Columbus

3. Augusta

4. Macon

5. Savannah

6. Athens

7. Sandy Springs

8. Roswell

9. Johns Creek

10. Albany

Appling , Atkinson , Bacon , Baker , Baldwin , Banks , Barrow , Bartow , Ben Hill , Berrien , Bibb , Bleckley , Brantley , Brooks , Bryan , Bulloch , Burke , Butts , Calhoun , Camden , Candler , Carroll , Catoosa , Charlton , Chatham , Chattahoochee , Chattooga , Cherokee , Clarke , Clay , Clayton , Clinch , Cobb , Coffee , Colquitt , Columbia , Cook , Coweta , Crawford , Crisp Dade , Dawson , Decatur , De Kalb , Dodge , Dooly , Dougherty , Douglas , Early , Echols , Effingham , Elbert , Emanuel , Evans , Fannin , Fayette , Floyd , Forsyth , Franklin , Fulton , Gilmer , Glascock , Glynn , Gordon , Grady , Greene , Gwinnett , Habersham , Hall , Hancock , Haralson , Harris , Hart , Heard , Henry , Houston , Irwin , Jackson , Jasper , Jeff Davis Jefferson , Jenkins , Johnson , Jones , Lamar , Lanier , Laurens , Lee , Liberty , Lincoln , Long , Lowndes , Lumpkin , Macon , Madison , Marion , McDuffie , McIntosh , Meriwether , Miller , Mitchell , Monroe , Montgomery , Morgan , Murray , Muscogee , Newton , Oconee , Oglethorpe , Paulding , Peach , Pickens , Pierce , Pike , Polk , Pulaski , Putnam , Quitman , Rabun , Randolph Richmond , Rockdale , Schley , Screven , Seminole , Spalding , Stephens , Stewart , Sumter , Talbot , Taliaferro , Tattnall , Taylor , Telfair , Terrell , Thomas County, Tift , Toombs , Towns , Treutlen , Troup , Turner , Twiggs , Union , Upson , Walker , Walton , Ware , Warren , Washington County, Wayne , Webster , Wheeler , White , Whitfield , Wilcox , Wilkes , Wilkinson , Worth ,

And also in Alabama, Arkansas, Florida, Georgia, Iowa, Indiana, Kansas, Missouri, Mississippi, Nebraska, New Jersey, North Carolina, Ohio, Pennsylvania, South Carolina, Tennessee and Virginia. We appreciate each and every customer! Let us help you today (833) 516-9321.